How I Saved 20k in a Year Without Noticing

1. Set a goal to work towards

It is hard to get excited about the journey if you don’t know the destination. If you are aimlessly trying to save as much as you can it will not be as effective as someone who has set a SMART goal. I try to set short and long-term goals. I print out these goals and include a photo to visualise what I am working towards.

A 1979 study on Harvard MBA graduates found that those who had written goals and had a plan were earning ten times more than the rest of the class.

If the goal seems unattainable or you are not motivated to achieve it break it down into smaller goals. If you need motivation I love this video by Jennifer Cohen on The Secret to Getting Anything You Want

2. Visualise your progress with a savings tracker

Visual savings tracker are great for tracking your progress. I like to write the date each time I reach a new milestone, so I can see on how far I’ve come (and how long it took).

3. Learn more and stay inspired

I find learning more about personal finance through money podcasts, books and videos help me stay inspired and motivated. A few recommendations below ⬇️

Podcasts:

The ABC The Money

She’s on the Money by Victoria Devine

My Millennial Money by Glen James

Books:

Scott Pape -The Barefoot Investor

Effie Zahos - A Real Girl's Guide to Money: From Converse to Louboutins

Nicole Haddow Smashed Avocado: How I Cracked the Property Market and You Can Too

Canna Campbell- The $1000 Dollar Project

Youtube: Canna Campbell SugarMummaTV and The Financial Diet

Websites: Money Smart

4. Organise your life and declutter

Decluttering makes you realise how much money you wasted buying pointless crap! I have found that by going through a decluttering process, I appreciate my money so much. If you ever try to sell something you realise how much better it would have been if you didn’t buy the item in the first place.

5. Avoid paying full price and support the second-hand economy

Facebook Marketplace, Ebay, Gumtree and Op Shops, there are so many ways to buy second hand.

SAVINGS HACK: If you are looking to buy something specific, then set up email alerts on Gumtree & Ebay to be notified when someone lists the item you want for sale.

If you are buying something new, there are browser extensions that can tell you when the item goes on sale. For example, the chrome extension ShopTagr.

6. Question yourself

1). Think of spending in terms of how many hours at work would it take for you to pay for it (your hourly rate should be after-tax). Then ask yourself, how many hours at work will it take me to buy this? This $100 dress will take me 5 hours of work to afford it, is it worth it? Probably not.

2). What is the cost per wear of this item? Sometimes quality is better than quantity (also from an environmental standpoint).

For example, if I buy a dress from a fast-fashion retailer for 20$ and only wear it once (CPW is 20$) but if buy a high-quality item that I absolutely love for 100$ but wear it 10 times, (CPW is 10$). It is better value for me to spend a little bit more to ensure it’s something I will absolutely love and wear.

3). Why are you spending money? Bored, low self-esteem, are there other ways to combat this? Or is it a spending habit that’s hard to break? (this is a whole other topic in its self).

7. Look at bank statements to find expenses to cut back on

Bank apps are getting so much better at giving us a breakdown of where we spend our money and on what categories. For me, a large percentage was being spent on eating out.

I ask myself, does this spending align with my values? Ideally, where do I want to spend my money?

I realised eating out wasn’t a value of mine (unless it’s with friends), I’d rather save my money towards travel and experiences. I have since discovered No Money No Time a blog with recipes for people like me who aren’t into cooking and want to save money.

8. Keep receipts so you can claim the warranty

I save money by keeping all of my receipts and taking note of the product warranty so if the item breaks I can take it back. I have saved so much money returning items instead of having to buy new ones!

9. Unfollow brands

Unsubscribe from brands’ emails and social media accounts trying to sell you things. Out of sight out of mind. I also use BlockSite a free chrome extension to block shopping websites, so I don’t accidentally find myself 5 pages deep on The Iconic’s new arrivals section.

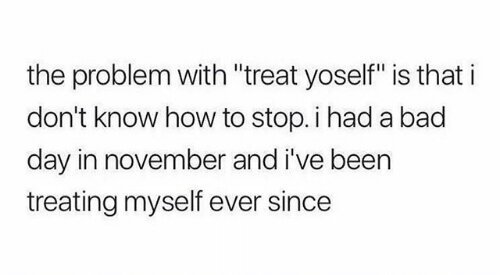

10. Celebrate wins and reward yourself

I like to pair my goals with rewards. Setting incentives for myself is a form of extrinsic motivation and is one of the lowest forms of motivation hacks, I know! However, it works for me because it puts time between me and the purchase. The wait helps me decide if it is something I really want.

For example, I will exercise twice a week for 3 months before purchasing new workout shoes. Sometimes the only way I can motivate myself is by dangling a carrot in front of my face. Not ideal, but sometimes it’s the only way.

FINAL NOTE:

Everyone's financial situation is different and you can’t compare yourself to anyone else (I MEAN IT, you have no idea what privileges they may have had!). If you are really struggling please seek professional advice, in Australia, we have free services including National Debt Helpline, National Legal Aid and ASIC Money Smart Website